Did you know that many people are paying a monthly payment of anywhere between $50 – $400+ per month for insurance that doesn’t even benefit them? Yep, it’s called private mortgage insurance or PMI. This insurance benefits your lending institution if you default on your loan. If you have bought a home and put less than 20% down on the home, you are most likely paying PMI. PMI is wrapped up in your mortgage payment so many people don’t even realize they are paying it.

But if you are paying for PMI there is good news and bad news.

The bad news is that PMI is required for those who don’t put 20% down on their home when they purchase it.

The good news is that the bank is required to stop charging you in certain circumstances.

Seven Ways to Get Your PMI Canceled

First, if you have paid down your mortgage to 80% of the original loan, you can call your lending institution and request that the PMI be canceled.

Second, if you haven’t paid your mortgage down to 80% but have done improvements to your home that increased the value, you can have your home appraised. If the amount remaining on your mortgage x 1.25 is less than the new appraised value of your home, you can request that the PMI be canceled.

For example, say you owe $170,000 on your home and it just appraised for $220,000 due to a home remodel. Take $170,000 x 1.25= $212,500. $212,500 is less than the value of your home ($220,000) so you can request your PMI to be canceled.

Third, if prices have gone up in your area since you purchased your home, you can have your home appraised. If the amount remaining on your mortgage x 1.25 is less than the new appraised value of your home, you can request that the PMI be canceled.

For example, I bought a fixer-upper home (before and after photos here) for 40k more than the appraisal value (explanation of why here) and began paying PMI on the home loan. Then the market went up quite a bit just as we had completed our renovation. We had the home officially appraised by a certified appraiser and our equity went up to 70k. Our loan to new value was such that we were able to get our PMI removed.

Fourth, if you have paid for your loan for half of its time-frame/schedule (15 years on a 30 year loan), you can request that the PMI be canceled.

For example, say you have a balloon interest loan or a loan which is heavily front weighted in interest, you may have made payments for 15 years on a 30 year loan and not yet reached the 20% equity required to cancel PMI. Despite not owning 20% equity, once you hit the half way mark on the loan you can request PMI cancellation.

Fifth, start paying extra towards the principal and speed up the time frame you have until you own 20% equity in your home. I show in this post 3 secrets to save over $100,000 on your mortgage that banks don’t want you to know about how quickly gaining equity can happen by upping payments to principal.

Sixth, If you will end up being able to put down 20% on your new loan, you could try refinancing. Refinancing can be a costly decision. Before you refinance read my Pros and Cons of refinancing here.

Seventh, Wait until you have paid off 22% of your loan and your lender will automatically (as is required) terminate the PMI on your loan. Going this route will cost you months of PMI payments when you could technically request a cancellation once you have paid off 20% of your loan instead of 22%. So I really don’t recommend waiting till your lender automatically cancels.

Important Notes-

- You must be current on your payments in order for PMI to cancel.

- Your request to cancel in most cases must be in writing.

- Your lender may request that you provide an appraisal. So contact your lender BEFORE paying for an appraisal and ask them what the process is to get an appraisal done that will be qualified to cancel your PMI.

- With FHA loans you may have to have had the loan for at least 5 years and have paid down to 78% before they will remove the PMI. Although we had an FHA loan and it dropped with the appraisal within the first 6 months, rules are constantly changing. If you have an FHA loan ask your lender what the current rules are.

- If you have a first and second mortgage and together your equity does not meet 20%, lenders are not required to drop the PMI.

- The mandate to automatically remove PMI at 78% only affects new mortgages funded after July 1999. Fannie Mae and Freddie Mac have said they will apply this mandate to the older loans.

Canceling your PMI as soon as possible is a great way to put an extra $50-$400+ back into your pocket each month.

Another article or two that may be of interest:

3 Secrets to Save $102,533.35 on your mortgage that banks don’t want you to know about

For other rich living tips and gourmet recipes, please subscribe, like me on Facebook, and follow me on Pinterest.

Remove Fha Insurance Mortgage - Buildearth

Thursday 20th of June 2019

[…] 7 Ways to Cancel Your P.M.I. (Private Mortgage Insurance) – 7 Ways to Cancel Your P.M.I. (Private Mortgage Insurance) – With FHA loans you may have to have had the loan for at least 5 years and have. […]

when can pmi be removed | Denverpost

Sunday 31st of March 2019

[…] 7 Ways to Cancel Your P.M.I. (Private Mortgage Insurance) – Seven Ways to Get Your PMI Canceled. Fourth, if you have paid for your loan for half of its time-frame/schedule (15 years on a 30 year loan), you can request that the PMI be canceled. For example, say you have a balloon interest loan, or a loan which is heavily front weighted in interest, you may have made payments for 15 years on. […]

Stop Loan Pmi On I Paying Fha When Can - Webbdemocrats

Thursday 28th of March 2019

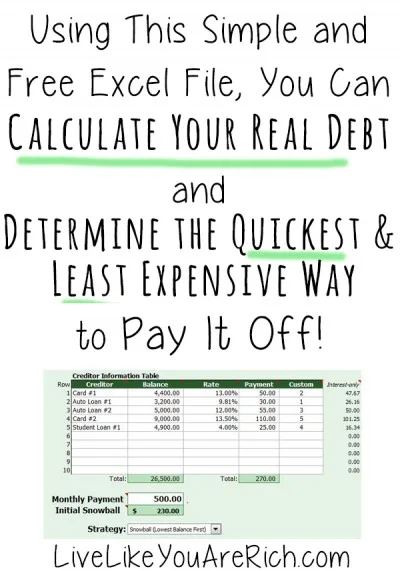

[…] 7 Ways to Cancel Your P.M.I. (Private Mortgage Insurance) – If you have an FHA loan ask your lender what the current rules are.. loans. Canceling your PMI as soon as possible is a great way to put an extra. Using this Simple and free excel file, you can calculate your real debt and. […]

refinance to remove fha mortgage insurance | Valoansrequirement

Thursday 28th of March 2019

[…] 7 Ways to Cancel Your P.M.I. (Private Mortgage Insurance) – With FHA loans you may have to have had the loan for at least 5 years and have paid down to 78% before they will remove the PMI. Although we had an FHA loan and it dropped with the appraisal within the first 6 months, rules are constantly changing. […]

Cancel Fha On Loan Pmi - Runproductions

Wednesday 27th of March 2019

[…] 7 Ways to Cancel Your P.M.I. (Private Mortgage Insurance) – With FHA loans you may have to have had the loan for at least 5 years and have paid down to 78% before they will remove the PMI. Although we had an FHA loan and it dropped with the appraisal within the first 6 months, rules are constantly changing. […]

Cindy

Tuesday 21st of December 2021

Our FHA loan amount is less than what our home is worth. $100k less. So how do we get the mortgage insurance cancelled since the loan would be paid in full with profit if we default?