Today I’m excited to share a get-out-of-debt-success-story with you. It’s actually the story of a life-long family friend, Stephen Gardner and his wife working together to do what many young families dream of: becoming debt free. Since we have been great friends for a long time, I was able to watch a few of the struggles and the many successes he has had during this process. And because Stephen has always been an honest person and very willing to share his experiences to help and inspire others, I asked if he would share their story with you.

Welcome Stephen…

We get what we focus on and what we think about is amplified. For many years I had the wrong thinking about money and debt. Maybe you are like me in that you felt big and important when the bank gave you a large credit card credit line. Like that made you rich and powerful. When in fact most lenders know that if you give someone credit most will use it. This is how they trap you! Ever heard the phrase, give someone enough rope to hang themselves? Welcome to the destructive world of credit cards. It’s no secret that American’s are in debt and it is cramping our wealthy building style. Not to mention our freedom. To really understand how dirty and evil the industry is, see the documentary Maxed Out.

There were months I would make a payment on a card and I could swear the balance was the same as last month. In fact every time I made a payment I would ask myself how it got this high. What did I buy or do to get into this much debt? Most times there wasn’t a good answer. I simply wanted something and I wanted it right then. I had vacations and splurges I was still paying on years later. I had been a fool in a world of easy credit and fancy things. Not anymore!

I didn’t want to be trapped anymore. I didn’t want to feel like a slave to my debt. So I got very clear on my goal to become debt free. For nearly 3 years I carried an index card that said Get out of Debt. Every time I took out my phone or my keys or my wallet that card would remind me that my goal was to be debt free. As the card would wear out I would simply replace it with a new card. My determination to become debt free had to outlast the durability of the index card.

Tips to become debt free:

- Stop adding to the debt. I had to take all credit cards out of my wallet and my wife took hers out of her purse. If it wasn’t there to use, it was amazing how little we needed the item or activity.

- Use cash for a little while to reset your wants versus needs thinking pattern. There is no emotional attachment to sliding a plastic card, but handing over cash makes you really think through your purchases.

- Do an autopsy on where you are spending your money. Believe it or not, we were spending a lot of money eating out and on clothes. Just knowing that made it easier to make changes.

- Have a budget. We didn’t have a budget to track how much we spent. We had a budget to assign where our money would go. That included debt, savings, church contributions and all the other monthly obligations we had. By assigning the money out, you know where it needs to be. During those 3 years anything extra needed to go towards my goal of getting out of debt.

- If you are married, get on the same page about your money. Every Sunday my phone alarm would go off at 9:15 pm to discuss the coming week’s finances and what we needed to spend money on, when pay checks would come and where to assign the money. It became fun!

Did this mean I ate only rice and beans and lived a boring, hermit’s life? Absolutely not! We still had fun. We still had kids. We still saved money for our future. I just kept my focus on getting out of debt by throwing left over money at the credit cards as often as I could. And it paid off. I can tell you that my life didn’t really begin until my debt died. The relief my wife and I felt when we paid off that last bit of debt on March 11th, 2013 was amazing.

During the time we were getting out of debt, I learned so much about money and how to build true wealth. I even run a private investment group now that has done very well for my clients and I. Knowing I don’t have to give part of my pay check to a credit card company or a student loan is an amazing feeling and I invite you on a similar journey.

Growing up I was very blessed to work with many millionaires so I would ask them which books I should read to give myself an advantage in the future. Each would recommend different books but each would always recommend The Richest Man in Babylon. This is a book that you need to read, no must read! This book helped me understand the value of each dollar I acquired. It helped me realize that a portion of everything I earn is mine to keep. If I didn’t pay myself, no one would. And it also helped me understand that I couldn’t get rich by owing a bunch of other people money. I had to be the lender, not the borrower. I had to put myself back on the winning side of the interest equation or else I would be under the credit card companies control my whole life.

“If you go to work on your goals, your goals will go to work on you. If you go to work on your plan, your plan will go to work on you. Whatever good things we build end up building us.” -Jim Rohn

Determine right now that you will become debt free. It has become socially acceptable to be in debt and masterful marketers work very hard to convince you to part with your money. Do what I did and go buy a stack of index cards and write “Become Debt Free.” Make that a goal and a focus. Think about how it will feel to not owe Visa, Mastercard, Amex or Discover. Think about stacking money up in your bank account and investments versus someone else’s. A portion of all you earn is yours to keep if you believe it and make it happen. As the years go by that money will build and build to the point where instead of working hard for your money, it will be out working hard for you.

You must FOCUS until the debt is gone. Focus stands for Follow One Course Until Successful.

Now my wife and I take the extra money we were sending to the bank and the credit card companies and we put it into savings. We put it towards vacations and memories free from debt. We put it towards building our retirement nest egg. Being out of debt has made a world of difference in my world.

Stephen Gardner is a Safe Money Specialist. He is a speaker in the financial industry. For help building a tax-free retirement or contractually increasing your money like the big banks, you can reach him at [email protected] or 888-638-0080.

Thanks Steve!

For other ‘rich living’ and debt-free tips, please subscribe, like me on Facebook, and follow me on Pinterest.

Other posts you may like:

The 5 Step Plan: How to Get Out of Debt

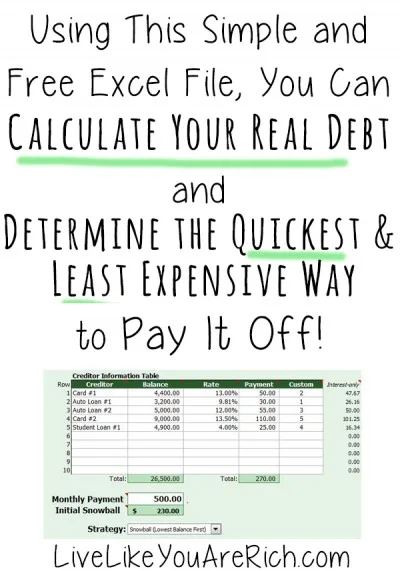

How to Calculate Your Real Debt and the Quickest-Least Expensive Way to Pay It Off

Diane taber

Sunday 14th of April 2019

Trying to get out of debt and hopefully save money for the future.

25 Days of Budget Transformations Day 2: A Visual Reminder Can Help You Work Toward Being Debt Free | Passionate Penny Pincher

Thursday 4th of February 2016

[…] a simple index card helped Stephen get out of credit card debt. Head over to Live Like You Are Rich for Stephen’s story. So […]