It is often a good thing to take a look at a debt calculator to find the total Real Debt (debt+ interest) that you will pay and when you will have it paid off. If you use a tool like this you can determine the least expensive way (least amount of interest) you will pay by paying off loans in a certain order.

You will also see the total how much money it will cost you to get out of debt. Further, a calculator/excel chart like this allows you to plug in a different ‘snowball’ or additional money to your loan payments to see how you can save considerably. Thus, I highly recommend using a chart like this at least a few times a year.

I love using a free debt calculator Excel or OpenOffice files like these:

Click here to download a Debt Calculator in an Excel File for 10 or less

Click here to download a Debt Calculator in Open Office/Excel for up to 20 debts or less.

I appreciate the company that put it together you can find them here.

Here are 10 easy steps to using the debt calculator:

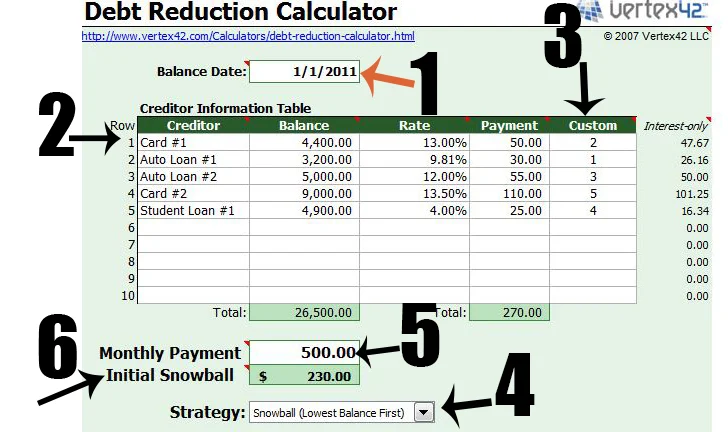

1- Input the current date.

2- Update your chart with the current loan names (Creditors), Balance, Interest, Rate, and Payments

3- For the custom column enter in the order you would like to pay off the debts in.

4- To make this much chart easier and fool proof, I enter the debts in the order I would like to pay them off in. Then select under the Strategy drop down menu: Order Entered in the Table.

5- Tally up the amount you have each month towards a debt payment. Subtract that from the minimum you must pay (in the Payment Total column) and you have your snowball payment. 5 = $minimum you have to pay + $extra money you can pay (i.e. snowball payment)

6- Enter your snowball payment which is the additional funds you can add to the minimum you must pay each month into the correct area.

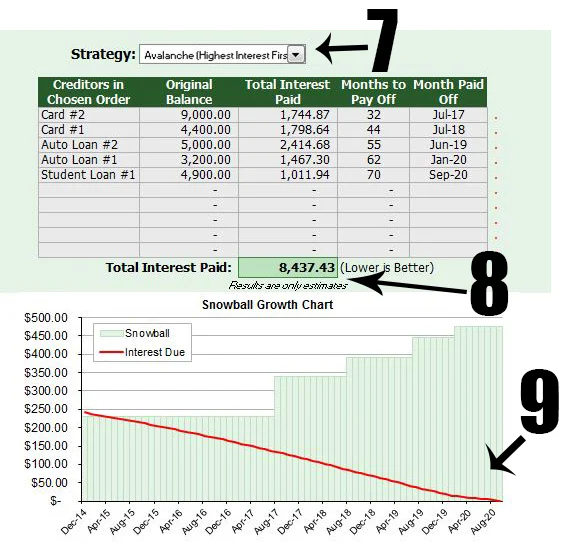

7- Next, experiment with different pay off strategies on the payment Strategy drop down menu. Select different strategies to see what the interest on your debt will be.

8- Which ever strategy gives you the lowest figure, that is in most cases the best way to pay off your loans in.

9- Shows you a curvature in the chart in the order the debt will be paid off. It also shows you in which year and close to the month in which the debt will be paid off.

10- Once you pick pay off the structure you can calculate your Real Debt by adding your Debt+Interest=Real Debt. This would be done with a calculator as I do not see a place on the chart that shows this. So pull out a calculator and add the debt figure from the first chart and the interest figure from the second chart and this will show you your Real Debt figure.

Knowing your Real Debt is important because it gives you or full financial picture instead of just how much you owe, it shows you based on certain criteria how much you will end up PAYING. So it is a huge and important factor in your financial life.

Using this chart you can find the best payoff order/structure in which to pay off your debts. I do have one thing to add to this chart. Although, mathematically correct and math is great because it is never wrong, I find that psychologically if you have a very small loan and you can get rid of it right away, paying that one off first is the best because it makes you feel good about getting out of debt (at least for me). One less loan to worry about etc. Overall, which ever order you feel best about paying your debts off in, is of course up to you, this chart just helps you see which order will save you the most in interest. This chart also helps you see your real debt number (debt you have + interest= Real Debt).

Please comment below if you have any questions about this chart. although I did not create it, I am very familiar with its functions. Also, there are a lot of helpful suggestions, notes, and explanations to the side of the chart on the actual excel file that you download.

Other articles that may be of interest to you:

Take my 31 Day Financial Fitness Boot Camp Course (click here)

5 Step Plan to Get Out of Debt

The difference between good and bad debt

For other ‘rich living tips’ please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.

SUBSCRIBE FOR OUR EMAILS

Vanessa

Sunday 1st of July 2018

HI!! Can you email the filters to me too??

Anita

Wednesday 1st of August 2018

Vanessa- I emailed you the file. Thanks!

Rozella Tames

Saturday 31st of March 2018

This website is just gret. I've looked these informations a long time and I view it that is good written, easy to understand. I congratulate you because of this article that I am going to recommend to the people around. I ask you to go to the gpa-calculator.co page where each pupil or college student can find ratings grade point average rating. Success!

Anita

Monday 18th of June 2018

I'm glad you find this helpful. Thank you!

Sara

Thursday 28th of December 2017

Hi! I can't get the spreadsheet for more than 10 debts to work. It doesn't update.

Anita Fowler

Monday 8th of January 2018

Hi Sara, the free version can list up to 10 creditors only. If you have more than 10 creditors, get the new Extended version that lets you list up to 40 creditors. Link here https://www.vertex42.com/Calculators/debt-reduction-calculator.html. Thank you!

Stephanie Sofka

Sunday 30th of July 2017

I can't seem to get my spreadsheet to work in Numbers. Any help would be greatly appreciated. :)

Anita Fowler

Tuesday 8th of August 2017

Stephanie- The spreadsheet works on Excel, OpenOffice and Google Sheets. You can go to this link https://www.vertex42.com/Calculators/debt-reduction-calculator.html to download. Thanks!

Chad D

Friday 16th of June 2017

I used this exact sheet but I got it a while ago from a different site but I started with 4 credit cards, my vehicle and house. I think I had about $15,000 in credit cards, maybe $13k-$14k on the truck and the house was $197K. I have since paid off all of my cards, my truck is down to $8,200 and the house is at $183k. I'm putting $1,800 a month to my truck and it will be paid off by November. After that the wife and I are going to put an extra $2,500 a month to our house and pay it off in 5 years. That is the plan and we know life happens but having a plan and a budget make all the difference in the world. I would also suggest using everydollar.com, it's free and you can build a budget and see exactly where your money goes.

Anita Fowler

Friday 23rd of June 2017

that's awesome! thanks for sharing!