You may be wondering if velocity banking is a good idea. The short answer is: no.

Why not?

To understand whether or not Velocity banking is a good idea, you must look at the numbers and do the math.

When I did the math, it did not add up, and as we all know, numbers, when calculated correctly, do not lie.

I was seriously considering using a HELOC loan to pay off our mortgage early. This is what is commonly referred to as velocity banking.

I ran the numbers and the math did not add up.

How did I run figure this out?

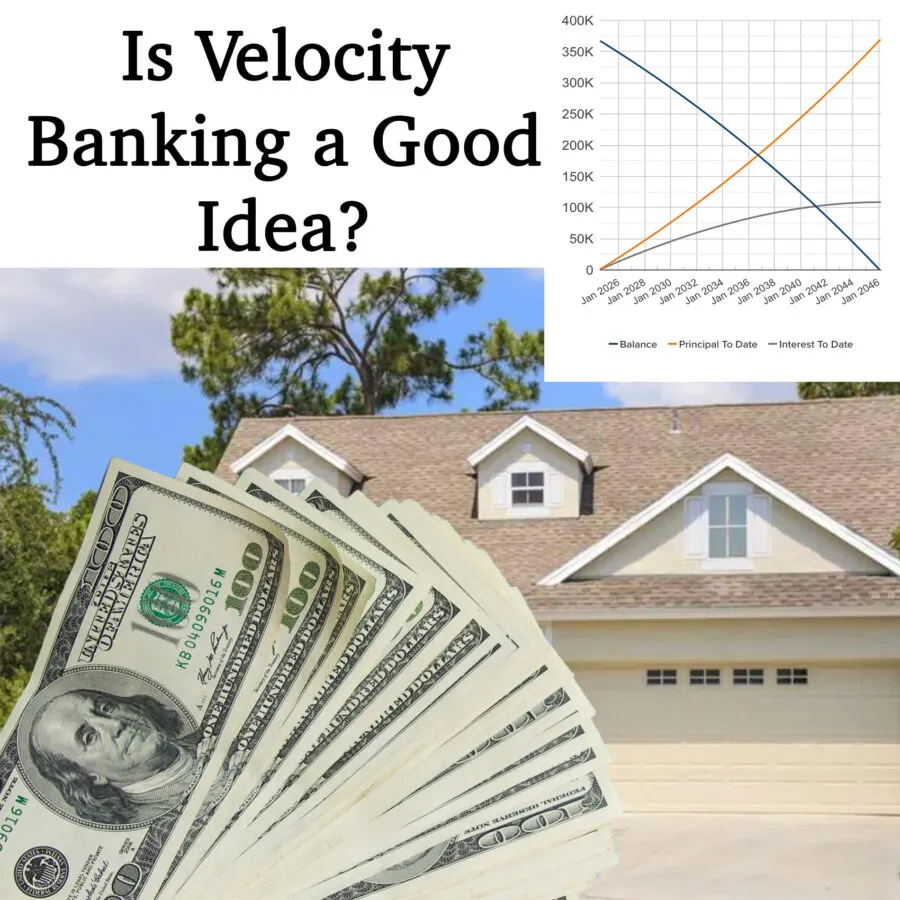

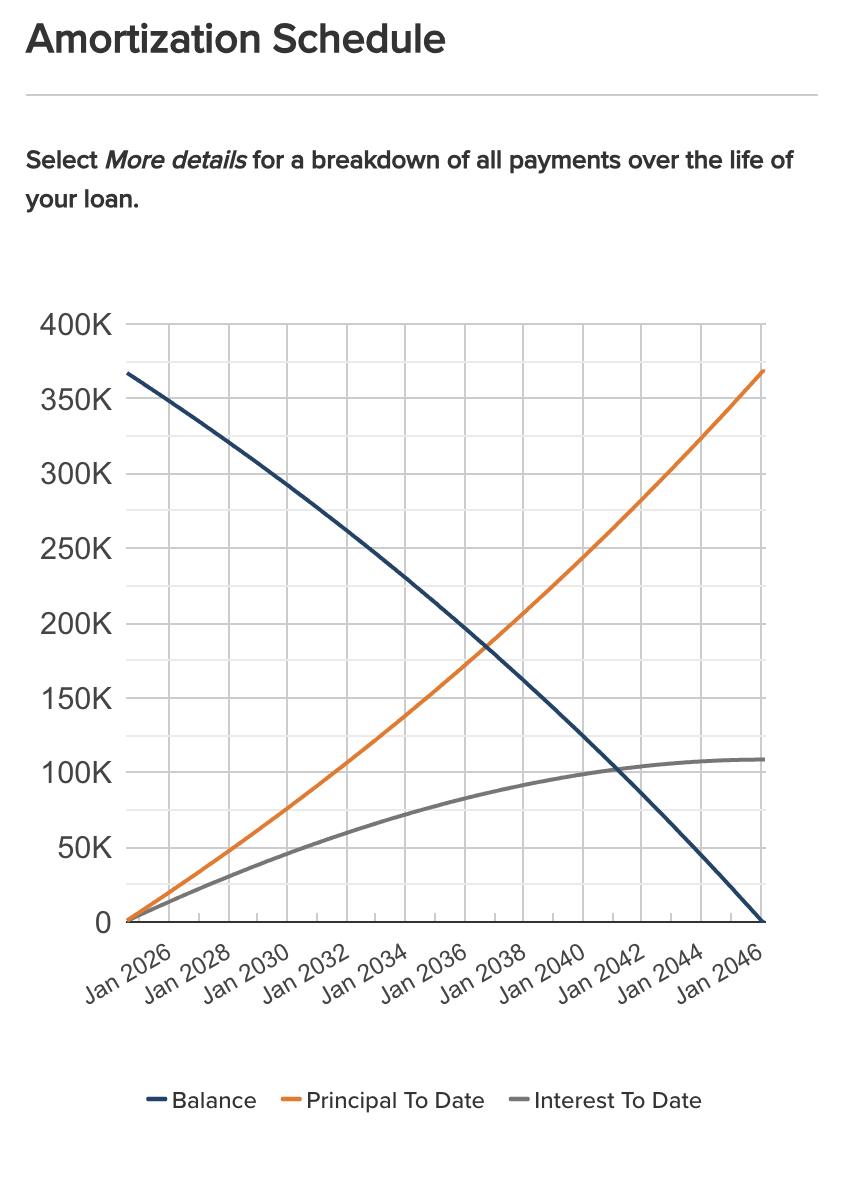

1- First, I went online to my mortgage portal and opened up my amortization schedule.

2- I chose a theoretical amount of $50,000, and I looked at what the interest would be on our mortgage if I paid off the loan with a lump sum of $50,000. I saw that on our 2.5% interest home loan, we would only save $100 a month in interest by paying off $50,000 in a lump sum.

3- Next, I calculated the interest on a $50,000 HELOC loan at 7% ($50,000 x .07), which is $291.67 monthly.

4—Then, I calculated running our income through a HELCO to pay it off and also to use it for expenses. I could not make enough of a dent in the $50,000 HELOC loan to avoid paying interest of at least $200 a month (which is $100 more than the HELOC would benefit me on my mortgage loan). So, using this Velocity Banking strategy means I would pay at least $100 more in interest by utilizing Velocity Banking.

5- I downloaded a free Velocity banking calculator from a popular YouTuber and plugged in the numbers. It came out that my utilizing the $50,000 HELOC I’d shave off about 7 years on my home loan and $29,000 of debt. I am unsure how this number is possible because when I used a more trusted loan/debt calculator, I got different numbers.

Instead of going through this Velocity Banking hassle, I can also shave off many years of loan time and interest by applying an additional $200 to the principal monthly.

Simply applying $200 a month to principal saves me thousands and years plus, I am not paying interest on two loans, I do not have to worry about the hassle of opening up a HELOC, getting an appraisal, and rearranging all my expenses so that they are run through the HELOC, and I do not risk my home by putting it up as collateral on a second loan.

So, while many YouTubers profess that velocity banking is a good idea, for most people, when they run the numbers, it is not.

I found this YouTube video by financial expert William Lee very helpful in determining whether or not velocity banking is a good idea.

So is Velocity Banking a good idea? No, for the average person, it is not.

Disclaimer—If you have a very high-interest mortgage and can get a HELOC for much less, it could save you money. Do the math; again, the numbers don’t lie.

Final note- Be wary of free velocity banking calculators. Use unbiased loan calculators to do the math. Or get a trusted accountant’s opinion.

Get my financial book, Living a Rich Life as a Stay-at-Home Mom: How to Build a Secure Financial Foundation for You and Your Children here.

For other ‘rich living tips’ please Subscribe Here for my weekly email or connect with me on these other platforms: