This is a sponsored conversation written by me on behalf of Varo. The opinions and text are all mine.

Why do we sometimes pay for things when a similar product is free? Why would we buy an item if we could buy the equivalent for significantly less? Perhaps convenience, perhaps we think we are getting a better product, or maybe we just don’t know that there is an equivalent free/cheap option out there. I think its often the later reason—people don’t know there are free options available.

So, here are 10 Easy Ways to Save Money That Most People Are Missing out On…

1- Audiobooks, DVD rentals and books can all be checked out for free via your local library. My kids and I love utilizing our library’s audio book app. We used to check out DVD’s and now we can get digital movies via the app as well. We check out books and other items at our library as well. A library card can save you a lot long-term!

2- Credit Cards. There are so many options of credit cards with great benefits that do not charge a yearly or monthly fee. If you are paying a fee for a card, I’d highly recommend switching over to a free option.

3- Cable. You can get free apps (PBS, PBS Kids, etc.) and other apps that allow you free streaming via a streaming device such as an Apple TV. I haven’t paid for cable for over 10 years and instead use my Amazon Prime account, free apps via my Apple TV and share Netflix, Hulu, and VUDU subscriptions with family members to cut down costs. I have almost all—and in many cases more— movies and TV shows available (usually without the commercials) for a fraction of the price.

Find out which channels your favorite shows air on and research to see if they have a free streaming app. You may be surprised how many you find and how you get shows you paid big bucks for free!

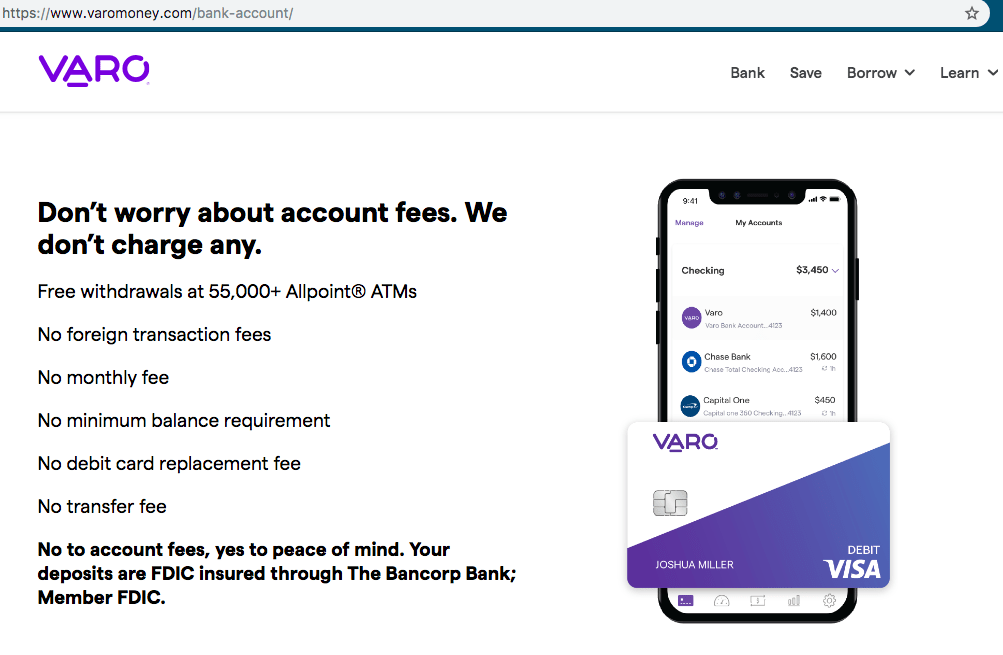

4- Bank accounts. Why, oh why do people pay for a bank account? Do you realize that the bank earns money from your money? They re-invest your money and make money off of it. So, why pay them to make money? Yet, a ton of people do!

Not only do many financial institutions charge you to bank with them, but they have fees attached to almost everything.

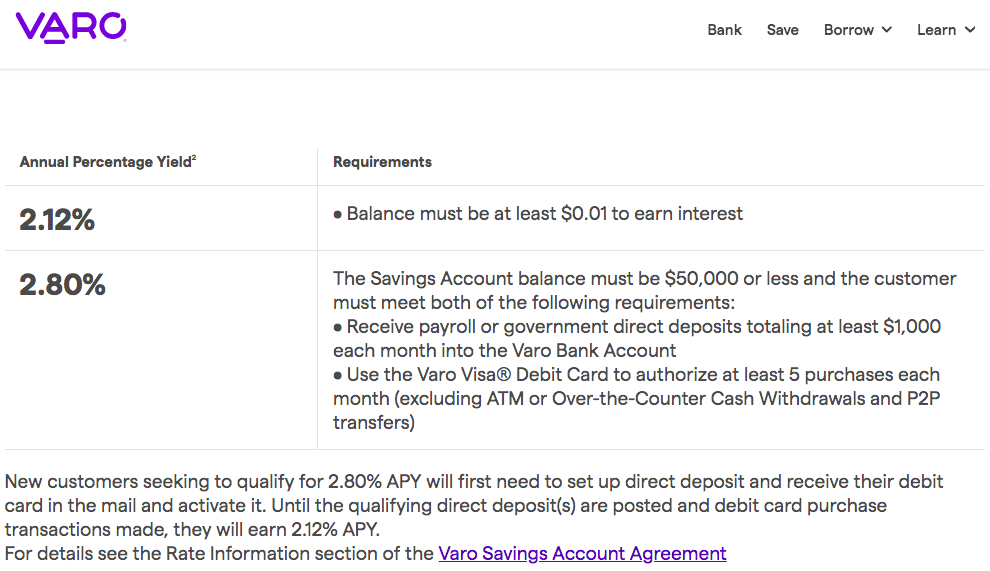

One company that truly gets this and reciprocates their earnings to us as consumers, is Varo (rhymes with borrow). Not only is the bank account free, they don’t charge the fees other banks and credit unions do. See the graphic bellow.

Varo also gives back. You can earn a good interest rate when you save with Varo. Every penny gets put to work in a high-interest Varo Savings Account. The national average on a savings account is 0.09% yet at Varo you can earn up to 2.8%. That’s pretty incredible!

Most areas have public libraries, parks, activities, splash pads, lakes, sledding hills, free entertainment, yearly community events, etc. for families and especially for young children. All it takes is a few online searches for free events in your area and perhaps a few additional searches on your community event pages. Another great resource for free things to do are a map of parks, splash pads, sports courts etc. these are typically all free to use, and you have a huge variety of free activities for kids.

Last summer I was really crunched financially. My kids had no idea, because we were constantly going places. We usually did something fun each day and it was all free! We’d go to library reading time, splash pads, parks, free events, a local mall has a monthly party for kids, free craft events, swimming in lakes, and hiking on free trails. We’ve gone to the state zoo and aquarium on their ‘open to the public’ free days as well.

And, if they really wanted to see a movie I’d ask them to save up a dollar by doing chores and wait until the movie hit the dollar theater.

Unless its a charity/tax-write off, I’d highly recommend sticking with free entertainment—especially for young children. If they grow up accustomed to these free activities, when they get older hopefully it will help them appreciate inexpensive activities as well.

6. Planting your own vegetables or fruit.

This takes time and work but often the yield is a lot better product than you get at your local grocer. Growing your own food, is a great way to get food for ‘free’.

7. Subscriptions to magazines.

Most magazines have content that can be viewed online for free. There is so much free information, ideas, etc. in just about every category online, that many people wouldn’t miss their magazine subscriptions if they turn to the internet instead.

8. Random treasures.

This isn’t for everyone, but I often peruse the ‘free’ section of my local online classifieds. I have found some really awesome free treasures.

One day a family was moving and offering all of their yard tools for free. I called and they said come and get them. They gave me shovels, a pick, an axe, a nice ladder, a push broom, trimmers, etc. I had just bought a house and had none of those items. I got them all for free!

I have found high-end artwork and custom furniture and decor for pennies on the dollar for my home.

Recently, we needed a handrail for a remodel we are doing and I found a 13 foot handrail made of real wood for free! We sanded, stained, and put protective coating on it and it looks like we bought it new. You can find random needed treasures for free or almost-free by perusing yard sales, online classifieds, and Facebook neighborhood-sale groups.

If I need something new, I go to the online classified in that particular category and search NEW. So it brings up only new items of what I’m looking for and I often get it over half off if I can find it.

9. Use coupons.

The best ones are $10 off $30 (a dollar amount off a purchase amount), 10% off your purchase (a percentage off the purchase), or Buy 1 and Get 1 Free (B1G1). These coupons or offers are typically pretty high in value. If you know that the price hasn’t been inflated to offset the deal, these types of coupons are really worth paying attention to!

I have done 3 remodels in the last 3 years. I have saved thousands by using coupons on items for the remodel.

My grandparents travel a lot as because of this, eat out a lot. My grandma has a folder of restaurant coupons that come in the mail and newspaper. She saves a lot by utilizing coupons (especially the B1G1 free coupons).

I am a huge fan of using coupons. I can’t tell you how much coupons have saved my family and I. I’d wager its in the hundreds of thousands.

10. A lot of car maintenance could be done for free.

I get windshield wipers, filters, windshield wiper fluid, etc. very inexpensively (by shopping around and using coupons) and then I refill them myself. K&N filters are reusable filters that you can wash and stick back into your car. These reusable filters save a car owner a lot of money over the life of the vehicle.

Some gas stations nearby have a free compressor for filling up tires.

I used to change my own oil until I bought a car that is designed much differently—and difficulty in changing it has gone up. However, a lot of the maintenance for cars (filling fluids, rotating tires, filling up tires with air, changing out wipers, etc.) can be done for a minimal price or even free vs. the exorbitant fees many mechanics charge for parts and labor.

Whenever I have a problem with my vehicle, I read online forums for the same make and model and see if there isn’t an easy fix before taking in to be diagnosed. This has saved me lots as well.

Bonus tip. Most people don’t do this, but if you buy bottled water for daily use, I’d recommend looking into a home water filter. I drink reverse osmosis water and thus would buy and drink a lot of bottles of water a week. I knew I was wasting some money, and that it wasn’t great for the planet (although, I did recycle all my bottles), but I wanted/needed to drink highly filtered water. One day, my friend convinced me to buy a reverse osmosis home water filter. Which I did. For the past years, I haven’t had to buy bottled water for my daily hydration needs and I’ve saved a ton of money. Filters are not too expensive when you consider they often last a very long time and save big money on bottled water in the long run.

Try using many of these tips, and you will see that they help you save money each month and year.

For other ‘rich living tips’ please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.

James Hendrickson

Monday 13th of September 2021

Another super easy way to save money is by turning out the lights when you're not using them. No need to light up a room if nobody is in there.

You can also unplug zombie appliances, for example, do you really need the microwave or toaster to be plugged in and drawing power?

Anita

Friday 12th of November 2021

Good tips, thanks for stopping by!