Solicitors often convince us to buy things we don’t really need, want, and/or items we often haven’t budgeted for. They are extremely effective, very convincing, and are usually hard to say no to—or don’t like to take ‘no’ for an answer. The very best way to avoid being solicited and impulsive purchasing are just to avoid soliciting and solicitors altogether.

Here are 3 Easy Ways to Avoid Solicitors and Impulse Purchases.

1- Put a “No Soliciting” sticker on your front door.

Putting a “no soliciting” sign up should deter door-to-door salesman from coming to your house. In almost any part of the United States, those who remain on your property against your express instructions (a no soliciting sign) are breaking the law. The individual states and The Supreme Court have traditionally respected the right of a householder to bar, by order or notice, solicitors, hawkers, and peddlers from his/her property. If they show up, just don’t open the door or ask them politely to respect your property notice and leave. The signs don’t have to be ugly or large. You can make one out of a stylish font and outdoor vinyl with a Cricut. You can ask someone you know who has a vinyl cutter to make one for you. Or you can just buy one on Amazon for cheap here.

Soliciting in person does not only occur door-to-door. In-person soliciting also occurs at the mall, in public parking areas, car dealerships, etc. My main defense against this kind of in-your-face soliciting is to not make eye contact with the salesman. If they approach me and start talking I say, “I’m not interested but thank you anyway.” If they push it (i.e. the guy at the mall who started putting lotion on my hand), I walk away from them.

2- Unsubscribe to emails, or set up a separate account for emails that solicit you to purchase.

I love certain retail email subscriptions. I get lots of coupons that I use for things I need or have saved for. This birthday month I got 10+ free meals and $30 of cash through email (find out how here).

Each day in my email account I get coupons, hear about amazing sales with free shipping, and more. It isn’t always good to have these emails going to your email account connected to your phone or constantly arriving in your main inbox because we then are often tempted to buy things we usually don’t want or need.

I’d highly recommend unsubscribing completely to the most-personally-tempting-and-expensive of emails. If you love Kate Spade, Nordstroms, or NewEgg deals and often find yourself clicking and purchasing unneeded items, it would be better to unsubscribe completely or change your subscriber settings to have them send you emails very infrequently.

One way to make this decision on who to unsubscribe to is to look at your bank/credit card statements for the past 6 months to a year. Which retailers do you find yourself buying items from that you did not plan/budget/save for? Unsubscribe from these completely.

Alternately, if you have a big purchase coming up (a dishwasher for example), it may pay to subscribe to Lowes, Home Depot, etc., to see if you get a coupon offer and to watch for sales on the item you need. Then unsubscribe once you find the deal.

I have set up an email for my professional use, I have one for my subscriptions, and I have just set up a new email just for my personal life. I am currently working on sorting through the email that holds subscriptions and am unsubscribing to the ones that do not provide me with coupons/freebies/and deals that I would use on planned purchases. Although some of it has been painless, other tasks in this project have been more taxing. That said, I am excited I will only be solicited to when I choose to be.

Soliciting via email also occurs through friends/family/acquaintances wanting you to attend product parties, FB events for parties, buy from their shops, etc. I have a lot of friends and acquaintances. If I went to every party I was invited to, I’d never stay in my budget and I’d be attending one every week.

The way I avoid these is to have a general rule that I do not attend any product parties at all, period. This way my friends aren’t as hurt when I don’t RSVP or come.

If I do want to purchase products I like that can only be purchased through a rep, I become one (I’m a Younique makeup rep as I really love many of their products, I was a DoTerra rep when I was building up my essential oil supply, etc.), or I reach out to the person in private and buy from them without attending a party.

3- Put your phone number on the National Do Not Call Registry.

In less than a minute, you can register your phone number for free on the National Do Not Call Registry. You can register your home or mobile phone for free here.

If you have registered and are not a business, and if it has been more than 31 days from registering, you can report businesses who are soliciting via phone to the FTC (link found on the registry website).

If you have a business phone number the registry may not work. So you may still get calls soliciting goods and services. What I do is 1- I often don’t pick up if I can tell it is a soliciting call or 2- I just cordially ask them to place my phone number on their own ‘Do Not Call List’ in the first second of talking with them, which they often agree to do.

Soliciting via phone will also occur via companies that say…

- You have won a free trip by filling out a form at the mall (that you never did fill out).

- You can get free flights by attending their meeting (this is a marketing scam).

- They need you to go somewhere as a secret shopper. I fell for a Secret shopping scam, I’m embarrassed to say, but it was the most elaborate set-up I’ve seen. They said they were Secret Shoppers (which I had applied for at one time so it wasn’t too far fetched). They reached out to me because they needed my help in my area and couldn’t find another viable secret shopper (another convincing thing). They sent me a contract for a $500 secret shopping trip to go undercover and bust a fraudulent company that had been reported by Delta and American Airlines (reading BBB on this company confirmed this). I checked the resources, signed the contract, and then went. I spent hours in the Ultimate Vacation Center time share meeting (the promised 45 minute meeting turned into a few hour meeting), and after saying no 7+ times and having it refused, I basically had to run from the building as the sales guy followed me out pleading and dropping the price 70% from the original price tag!I submitted my full report including photos, recordings, etc., to bust this fraudulent Ultimate Vacation Center scam company and it turns out it was the Ultimate Vacation Center that set me up. They did that whole elaborate scam to get me into the time share presentation!!!!!I could not BELIEVE the work they went through to get me into that time share office! Beware of this type of soliciting. And especially beware of The Ultimate Vacation Center fraud scheme/company.

Bonus Tip: What happens if they do have you convinced? Or if you really do want a product placed before you?

This tip comes from the book I co-wrote Living a Rich Life as a Stay-at-Home Mom: How to Build a Secure Financial Foundation for You and Your Children.

I share what I often ask myself if I am tempted to buy:

- Do I need the item?

- Did I budget for this item?

- Did I want the item before I saw it?

- If I didn’t buy it would I regret it?

- Do I want this item more than most other things I want/need right now?

- Is this a good price for the item?

- Is there a fair return/cancellation policy?

If I can answer yes to at least 4 of these questions, I feel safe that what I’m buying is actually not an impulse purchase and is worth it.

Conclusion

There are many things you can do to avoid solicitation. I hope these 3 Easy Ways to Stop Soliciting Before You Buy Impulsively help you to live a ‘richer life.’

Other topics that may interest you:

Need help getting and staying out of debt? Take my 31 Day Financial Fitness Boot Camp Course (by clicking here).

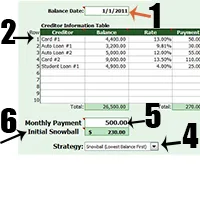

How to calculate your real debt and determine the quickest least-expensive way to pay it off

The difference between good and bad debt

For other ‘rich living’ and financial tips, please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.