With credit card debt reaching historical highs, some debt experts are encouraging consumers to ditch the credit cards and just use cash. Credit card debt can be a vicious thing. Interest rates often run very high and compound, the credit card itself may have an annual fee, there may be late fees, deferred interest, etc. Yet credit does a few very important things for consumers. In order to build credit and have a credit history, you have to use credit.

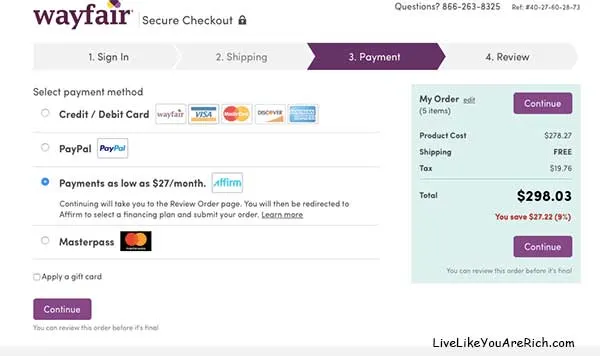

You also need credit in order to purchase many items and services—especially online or while traveling. Up until now, the options for building credit and buying online have been limited largely to using credit cards. Now there is another way. A great alternative to using a credit card to build credit and purchase items online is to use a company called Affirm.

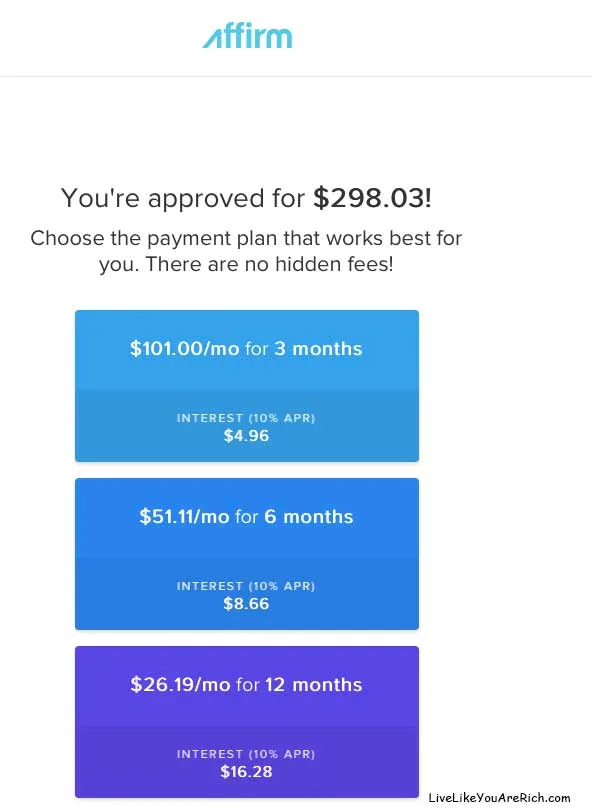

Affirm offers affordable financing at competitive interest rates for online purchases. I used Affirm to purchase some equipment for my business and some Christmas gifts online this year. I received a better interest rate than my credit card offers (about 5% lower than my credit card offers) and it is simple interest not compounding so I only pay interest on my purchase–not interest on my interest!

Another great thing about Affirm is that the financing I used to buy online is not considered revolving credit. Revolving credit weighs heavily on your credit score. The more revolving credit debt you have, the lower your score will be. For this reason, if you need to purchase items online, I would really recommend using Affirm—especially leading up to and around a time when your credit will be pulled (such as when thinking about purchasing a home, a car, etc.).

Affirm also takes the safety and protection of its customers’ information very seriously. When I used them to purchase items online I received text messages and emails to verify the purchases. They will keep all information secure and offer forms of protection similar to credit cards (the ability to dispute, return, refund, etc.).

I found it interesting to read what the CEO at Affirm had to say about this purchasing option…

“The financial industry has managed to avoid significant disruptive innovation since the mid-90s, and we are working hard to change that. Our first goal is to bring simplicity, transparency, and fair pricing to consumer credit. We are just getting started and have much work to do.”

- Home Furnishings & Appliances

- Apparel and Accessories

- Automotive Enhancement and Repair

- Travel

- Consumer Electronics

Here are just a few of the current online stores/companies that Affirm works with. There are many, and they are constantly adding more.

- One Kings Lane

- Wayfair

- CheapAir

- EventBrite

- Owlet

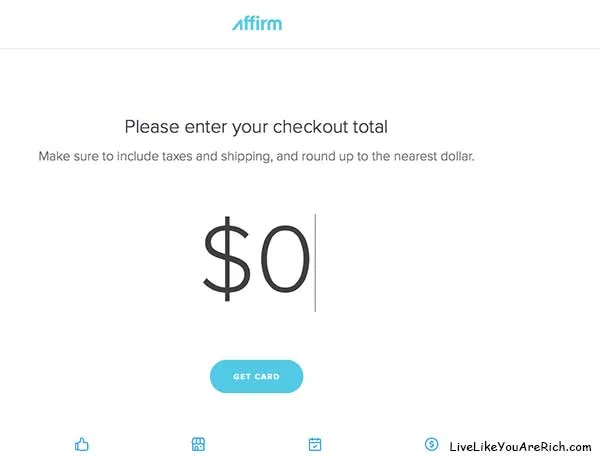

After checkout, stores can process and ship your order immediately (my items are already on their way). Affirm will keep in touch and remind you of any upcoming payments. You repay Affirm however you’d like – debit card, bank transfer or personal check.

I was very impressed at all of the options Affirm offers in online financing. I’m excited there is a company out there innovating consumer credit options and making the process of purchasing online items more consumer friendly. I hope this Affirm review was helpful and that you get to experience this innovative purchasing option. You can try them out here.

Follow Affirm on their Social Media Channels: Facebook, Twitter, Instagram, & Pinterest

SUBSCRIBE FOR OUR EMAILS

rajesh

Wednesday 11th of January 2017

a nice article you prepared for us and thanking you.