Today’s task may take a little more time than the last two, but it may save you thousands!

Many people know how much they owe in debt including credit, vehicle, mortgage, etc. but hardly anyone calculates their real debt figure.

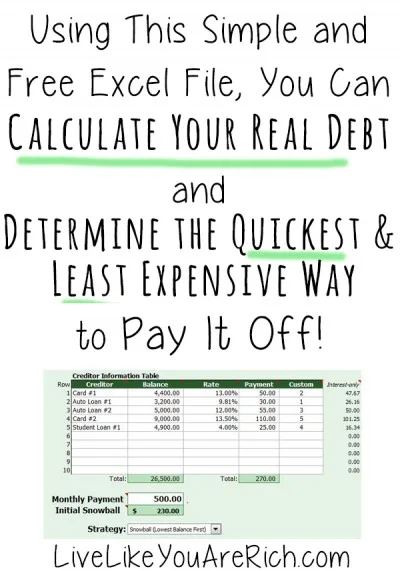

The number of debt owed plus the amount of interest paid over the life of the loan represents your real debt figure (or what you will actually pay). Thus, I have made an Excel and an Open Office file with clear step-by-step instructions on how to use them available. Filling out this free download will show you your real debt figure, how you can save by arranging the order of your debts payments, and when your debt will be paid off.

The file also allows you to input a snowball payment (additional funds added to your monthly minimum debt payment). For example, you could add a snowball payment of an extra $40.00 a month and the file will show you how much you would save you in the real debt total.

Using a file like this and seeing the savings that the order, additional payments, and timing make for real debt figures is powerful!

Challenge #3- Download the debt excel file found here, follow the instructions, and you will find out your real debt figure, what order of paying down debt is best, and see how much adding additional money to the monthly payments will save you.

If you only have one debt -say a mortgage-, you can see how much upping the principal you pay each month can make on the real debt and timing of the complete pay off as well.

By taking 25 or so minutes to download and fill out the file found here, you can potentially save thousands! Click here to get started now.

P.S. If you have any questions on how to use this file, please don’t hesitate to ask.

Other Posts:

Step 1 of the Financial Fitness Bootcamp Course

Step 2 of the Financial Fitness Bootcamp Course

For other ‘rich living tips’ please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.