Two and a half years ago, I was looking at the amortization/debt schedule of my dream home that I was about to buy. It was mind boggling how much money my family would pay in interest over the course of a 30 year loan! Even at the pretty low interest rate we had secured we would end up paying $134,739.01 in interest. That is 67% of the cost of our home. When I realized that I would be paying for our house more than 1 & 1/2 times over again including the interest utilizing a 30-year loan I asked to see a 15 year schedule.

On a 15 year loan the interest would only be $62,537.65 (31% of the cost of our home). But to save even more I asked to see a 10 year loan schedule. On a 10 year loan our interest would only be $34,525.68 (20% of the cost of our home) and over $100,213.34 less than a 30 year loan.

What did we decide? Ultimately, because we didn’t know what the future held, and for more financial security, we decided to go with a 15 year loan but we pay an additional couple hundred dollars a month towards principal. We are on track to have our home paid off in about 10 years. This will save us $100,213.35 in interest alone.

Not only that but if, after our mortgage is paid off, we took the same amount of money we paid for our mortgage payment and invested it instead of paying it to the bank for the 20 extra years (at 4% interest) it turns into: $714,674.00. If you add that amount to the interest we saved by going to a 10 year loan: $100,213.34 + 714,674.00= $814,887.34 saved/made in the same 20 years that we could just be paying off our house.

Isn’t your payment much higher you ask? It sure is. On the 15 year payment it was about $500 more a month. On our 10 year payment plan it is about $950.00 more a month. But we found a way to make an additional $1,000.00 a month and instead of spending it we apply it to our home loan.

I am willing to sacrifice $1,000 a month to have our home paid off 20 years early to save $100,213.35 in interest AND more than likely make $814,887.34 in the same time frame.

(Keep in mind this is on a $200,000 house with about a 4% interest rate. If your house is worth more and/or if you have an interest rate higher than 4.0% your savings and what you could make by investing will be much HIGHER!)

Even if you can only find an extra few hundred dollars to apply to your mortgage principal you will shave YEARS off your mortgage. Other ways to save are to stick to a spending plan and whenever you get extra money through your tax returns, bonuses, or selling things, etc. put them toward the principal on your mortgage as soon as you get them. You can also subscribe to learn other saving and money making tips.

If you don’t have an extra $950.00 to apply to your mortgage each month I understand. We have had to sacrifice some things and get creative. When I stopped working full time to stay at home with our baby things got REALLY tight. Even with my couponing and saving about $300 on food a month (as shown here), making money by selling stuff online (see how to do that here), and saving with phone apps, etc. it is sometimes tough. But saving over 100K on our mortgage and being able to invest afterward for retirement, etc. is worth it.

Below are 3 Secrets that the bank doesn’t want you to know.

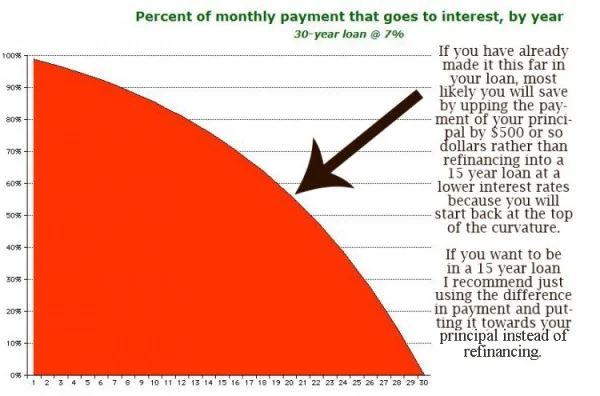

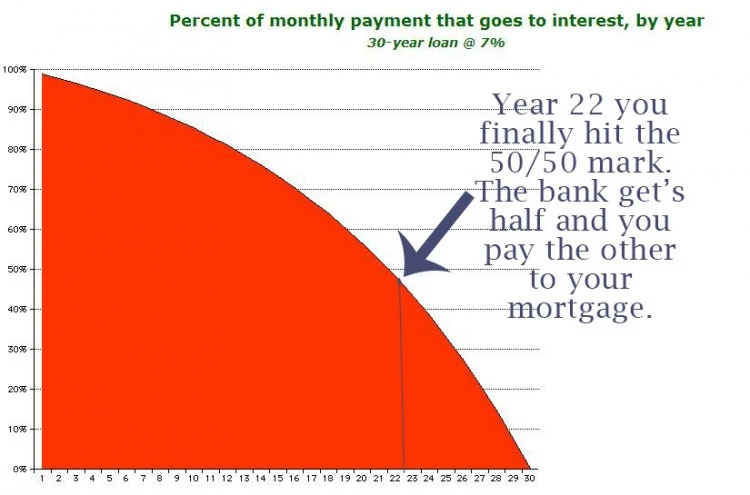

1- The banks don’t want you to know that they make LOTS AND LOTS of money in the first 12 years of 30 year loans and refinances. The first 12 years of your mortgage payment schedule is really heavily weighted in interest. It is not until year 22 that you pay more toward your principal than to the banks. If your monthly loan is $1000.00 a month on a 30 year loan with about a 7% interest rate, the first year you pay the bank about $930.00 a month in interest and about $70 goes to the amount you borrowed. Each year it goes down a little and finally once you hit year 22 then you are paying the bank about $500 and the other $500.00 goes toward principle.

Knowing this the banks TRY TO ENTICE EVERYONE to continue refinancing or selling their homes (the average American does one or the other about every 8 years). Why do they try to entice you to sell or refinance? If the banks can get you to refinance or sell before you hit year 12 on your mortgage they can continue making 80-97% in interest off of every single 30 year home loan they have!!! If you are thinking about refinancing this free report I’ve written is a MUST READ… But the main reason not to refinance is that if you start your entire loan over, your amortization schedule starts over (you go back to paying super high interest rates again).

Further, refinances cost about $3-$5,000 each. So don’t restart your loan based on the intention of paying it off faster—unless your interest rate drops significantly. Just set up a payment plan that takes out more than the monthly payment and MAKE SURE TO SPECIFY THAT THE EXTRA FUNDS GO TOWARDS PRINCIPAL ONLY. If you don’t specify some banks will use the extra as an additional payment and you will be paying that huge portion of interest with those extra dollars.

As noted by reader and loan officer Chris

“A lot of mortgage companies use a third party to collect bi-weekly payments. These companies tend to charge a large fee for their service and your payments are not actually applied to your mortgage balance bi-weekly. Due to foreclosure laws, mortgage companies do not typically accept partial payments so these companies wait until they have collected 2 half payments before they send it to your mortgage company. You can accomplish the same thing on your own by depositing 1/2 of your monthly payment every other week into a separate checking or savings account (and save more by not paying a third party). Once your have a full payment in that account, make your payment to the mortgage company. Just be sure that it is a full payment (and specify that it goes to the principal balance only) when you send it.”

2- Banks don’t want you to know that there are 7 ways to cancel private mortgage insurance. Mortgage insurance or PMI is another huge cost to owning a home. If you have less than 20% down you will be automatically charged PMI. If you end up having to pay PMI it is expensive.

For example: our home was a HUD home so we had to come to the table with a lot of cash over the appraisal. As a result we didn’t have enough for the required 20% down loan to value. For the first year our PMI was $580.00 a year (which is actually VERY low compared to most PMI payments). After we purchased the home we made a lot of updates to it and the market went up. We had an official appraisal done that increased the appraised value of our home by $70,000.

As a result, I was able to get the mortgage insurance taken off of our home.

PMI Rates can range from 0.5% to 6% of the principal of the loan per year based upon loan factors such as the percent of the loan insured, loan-to-value (LTV), fixed or variable, and credit score. Rates may be paid in a single lump sum, annually, monthly, or in some combination of the two (split premiums). So to save money it is best to avoid it altogether by saving up 20% of the loan before purchasing your home. If you have already bought your home, you can still find ways to cancel expensive PMI and potentially put $50-$400+ (depending on the price of your home) back into your pocket each month.

I explain the 7 ways to cancel your PMI here.

Total savings of mortgage insurance for 4 years that we would’ve had to pay it had we not gotten the appraisal done: $2,320.00

3-Banks often want to repossess. On repossessed homes banks not only make a huge amount of interest on your first years of faithfully paying the loan but they also get to keep the property and resell it again (making much more than if you had kept up with your payments). Guard yourself and create a good savings fund that is not touched except in dire circumstances. I talk about more about how to create a savings fund here.

Doing these three things can not only save you $102,533.35 on your mortgage, but you will also have a considerable amount of money that you can invest and/or save. Even if a 10 or 15 year loan is un-affordable, applying a few hundred extra dollars a month toward your principal and eliminating mortgage insurance will still save you thousands, even tens of thousands!

Thinking about whether to sell your home? Are you renting and wondering if you should rent or buy? I’ve published a book about these questions answered in detail. Find answers in my book:

Need help getting and staying out of debt yet want more interactive help? No problem. Just take my 31 Day Financial Fitness Boot Camp Course (by clicking here).

Other articles that may be of interest to you:

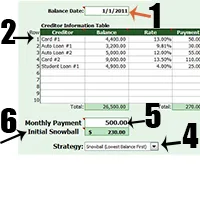

How to calculate your real debt and determine the quickest least-expensive way to pay it off

For other ‘rich living’ and financial tips please subscribe, follow me on Pinterest and Like me on Facebook.

SUBSCRIBE FOR OUR EMAILS

Jennifer M.

Monday 29th of May 2017

INTEREST IS TAX DEDUCTIBLE! So you're not really "saving" that money if you choose a shorter mortgage. What you *are* doing is paying down the principle quicker, so you acquire equity more quickly and can eliminate PMI.

Just don't fool yourself into thinking you're saving interest. That's a line the lenders will feed you because they WANT you to pay it off quicker - they have more of a stake in your house if you default.

For me, I put 20% down to avoid PMI but still go with 30 year to keep payments low. No need to struggle each month to try to meet a high payment.

How To Save Hundreds A Month On Your Mortgage | Last Mortgage

Tuesday 27th of September 2016

[…] 3 Secrets to Save $102,533.35 on Your Mortgage…That Banks … – 3 Secrets to Save $102,533.35 on Your Mortgage. Banks don’t want you to know that there are many ways to avoid paying mortgage insurance. Mortgage … […]

LoanShak » Saving The Most On A Mortgage

Tuesday 17th of May 2016

[…] It’s no secret that banks charge an insane amount of interest on any loan they give out. Especially for mortgages. In fact, for many years, you’re not actually making payments on your home- you’re just paying the bank thousands of dollars in interest only. Which is just crazy! For tips on how to avoid this and save up to $100,000 on interest, read this article by Anita at Live Like You Are Rich: […]

Enjoy your life, Don't get a Mortgage | Abby Design and Construction

Tuesday 5th of April 2016

[…] much easier for you. And your finances are now easier to deal with. You can read more on this link:https://livelikeyouarerich.com/3-secrets-to-save-102533-35-on-your-mortgage/ also. However, think twice before you decide 100% if you really need a mortgage or […]

Marybeth

Thursday 31st of March 2016

IN regards to point #3, no bank big or small wants to repossess a house. I know this cause I have worked in the default/foreclosure end of mortgage banking for 15 years. I was on the panel that developed HAMP before it was even called that. No bank wants a property back. Banks are in the business of lending money to make money, not to foreclose and then have to market and sell property. And 99.9% of the time the bank looses money when they foreclose. Depending on the state the property is in they could have thousands of dollars in legal fees. In Pennsylvania, New Jersey, and New York areas it cost anywhere from 5000.00 to 10K to forclose. Then you have the eviction process if there are people living there. Then there are repairs to at least make it livable and b able to market it. So it's very rare a bank even breaks even. Number 3 is dead wrong.

Anita Fowler

Thursday 31st of March 2016

Thank you for your perspective Marybeth!