How to Protect Your Loved Ones from Market Corrections and Economic Downturns

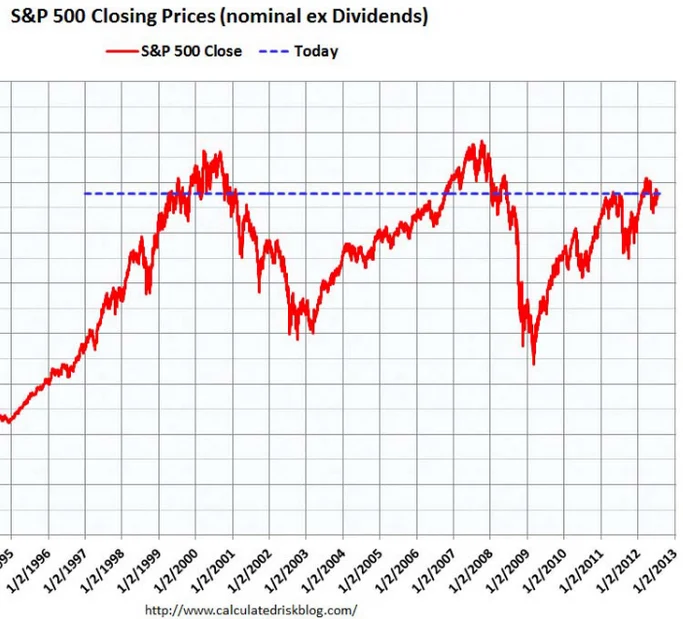

Market corrections have historically occurred about every 6-8 years in America, the last being in 2008-2009, and before that 2002. Some have been much worse than others. But the last two (in the past 15 years) experienced over a 40% drop. Many investors and economists say that we are at a place where a market correction could very likely occur this year or next.

Some market corrections hurt countries worse than others. In 2008 the real estate market was badly hit, in 2001 it was the dot com crash. Although these corrections hurt specific markets, they had widespread tentacles which affected the entire economy. The result of these market corrections included but were not limited to: loss of income (lower wages), job loss (high unemployment), higher prices on food and other necessities and commodities, foreclosures, inflation, etc. This next market correction (predicted to occur this year or next), could be better or worse, there is really no way of knowing.

Now, to make myself clear, I am NOT a ‘dooms-dayer’. I don’t like to sit around and think about the economy dropping; people losing their jobs, homes, etc.; an increase in prices of necessities and commodities; and businesses closing. I won’t speculate on how bad things will get or the exact month it will occur. These things are out of my control and I prefer to be optimistic. That said, I do believe it is always good to be prepared for an economic downturn especially because they have historically occurred in cycles and we are on the brink of a downturn based on the cyclical pattern.

So in case we do experience these unfortunate events, here are a few steps to protect your family and loved ones…

1- Have food set aside. You should store food for your family for 3 months. The best is to have food for one full year. Read this post on how to save money on emergency food storage. You should also have water to last you two weeks. It is doubtful that you’d need water in an economic downturn. But just in case of another kind of emergency (earthquake, etc.) during a downed economy, it isn’t a bad idea to have water storage. My religion emphasizes and reminds us, members, to always have 3 months to a year’s food storage for our families and a few weeks of water storage. Countless stories are told of people who have relied on their food storage during job loss, medical problems, disasters, and other unfortunate circumstances. Along the same lines, store seeds for a garden. If needed, you can plant a garden. Although most won’t be able to do this, having chickens, pigs, goats, or cows could also help keep fresh food on the table.

2- Protect yourself financially. Have three months of living expenses set aside. You never know if your main income will be hit—or disappear altogether. If something does happen and you have three months’ worth of expenses set aside, you will have time to look for more work, sell or trade items, and if applicable and it comes down to it, you’ll have time to try to sell your home (and not lose all its equity by being foreclosed upon). Note- It may be best to store this reserve in a safe in your home (just in case banks close). Also, invest in places (post here) where it is difficult to lose your principal. Hint- the stock market is not one of them.

3- Get out of debt. Do your very best to get out of debt as soon as possible. The less debt you have, the more financial freedom you’ll enjoy (especially in a down economy). Here are 5 steps to getting out of debt and a post on how to avoid debt once you are out of it. Many think they can get out of debt besides their mortgage and be fine. Until you have your primary residence paid for you are still at the mercy of the banks and lenders. Here is a post on how to save over $100k on your mortgage and get it paid off quickly.

4- Stock up on essential items with coupons while they are on sale. If you have room in your home (or can make room), it is a great idea to stock up on toilet paper, diapers, wipes, contraceptives, feminine hygiene products, etc. for at least a few months. Read my post 11 steps to save thousands with coupons here. Also, stock up on items you may not be able to afford in a recession like clothing. I go garage selling (learn how to garage sale efficiently here), and have clothes for my kids for the next two years. I get them for .50-$1.00 an item so I can afford to stock up. I’m stocked up on toothpaste, shampoo, conditioner, deodorant, etc. These items are fairly affordable now. In a down economy, the prices will rise. Learning to coupon will save you on food storage and other items. I have a great 45-minute system here.

5- Have a form of protection. Firearms (with ammunition), non-lethal TigerLights, etc. When people get desperate violence is often a result. Its important to be able to protect your family.

6- Learn how to be frugal and thrifty. Trade items, buy used, make them do, and get resourceful. Learn to sew and mend clothes, re-learn homemaking skills that our ancestors performed. There are so many ways to save money. Often we spend more just for convenience. Subscribe to my blog to learn more frugal and money-saving tips. Don’t get overwhelmed if you feel like there is too much to learn. There is a saying that I love, “By small and simple things are great things come to pass”. Saving a little here and there really does add up. The book I co-wrote elaborates in detail on this principle.

7- Learn how to work, fix, and repair things (AND teach your children). Growing up, I honestly thought we were poor. My dad and mom had very long lists of chores we had to get done each and every day. Saturdays were PROJECT days. We learned how to tile, hang sheetrock, per tape, re-shingle a roof, fix plumbing problems, fix sprinklers, do laundry correctly, and many other skills. I thought we had to do all of these things ourselves because we were poor. I have since learned that my parents were teaching us vital life lessons and skills. These would enable us to fix things, be more self-sufficient, save money, and most of all, empower us with a lifelong and vital work ethic. Prepare your family by teaching them skills and making them learn how to work hard.

If you think about it, if the economy were to tank and your main income was gone or severely hit and you had done these 7 things, you and your family would be completely protected for at least three months (or more). You’d have living expenses covered, food, clothing, and other necessities taken care of. You could breathe easy for at least a few months while you find another source of income or take action to liquidate your assets. This scenario is much better than what many who have gone through bad economic times have experienced. Many lost pretty much everything including built-up equity on homes and vehicles and ruined their credit scores.

Many are still recovering here 7 years later from 2008. So start now and get prepared. For an easy-to-accumulate and accomplish the plan, get the ’52 Week Family Preparedness Email Course’ for $4.47 for the entire year! By following this email course, at the end of the year, you will have a one-year supply of food storage, a 72-hour kit, a personal hygiene kit, a car emergency kit, and daily necessities to last for months. Click here to order now. If you want you can get (more info on it here).

For other ‘rich living’ tips, please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.

SUBSCRIBE FOR OUR EMAILS