There are many unique situations when people begin to think about refinancing. My first piece of advice is this: Never make any decision before you have spent plenty of time studying, researching, calculating and recalculating the numbers. Don’t just trust what the brokers say (although some may have your best interest in mind); it’s not always smart to ask advice from the people who only get paid if you DO decide to refinance. Here are the pros and cons of refinancing.

When I was pregnant our ten year loan schedule (really 15 year loan which is explained here) started to make me a little nervous. I was worried that when I started to stay at home we wouldn’t have enough money to make all of our payments (plus another family member to pay for as well).

At four months until my due date, I became severely limited physically due to PGP and I had to start working from home. I went from a salary position to hourly rate with fewer hours. As a result, we took a pretty big pay cut the four months leading up to our son’s birth, which made me even more concerned about our financial ability to pay such a high mortgage. So I began looking into the option to refinance into a lower payment loan.

I spent a lot of time researching the option to refinance. I had conference calls with multiple mortgage brokers, took notes, crunched numbers, and ultimately decided that refinancing was going to COST us a lot more than I was expecting. We decided to find extra ways to save and make money and to stay on schedule with our mortgage payment plan.

Not every situation is like ours. It may be the right thing for you, I don’t know. That is why I wrote the Pros and Cons I learned about refinancing. UPDATE- A few years later I decided to refinance. Information on that in the Pro section below.

Pros

Pro: Say you have a 30 year loan with a high interest rate and mortgage insurance. You have saved up enough that you would be able to refinance into a 15 or 10 year loan at a much lower interest rate and cut the PMI out entirely. You have crunched the numbers, adding the fees associated with the refinancing AND comparing the amount of interest you will have to pay over the life of the new loan with the amount of interest you have to pay on the remainder of your current loan. After all of this, you found that you can save by refinancing. In this case (as long as you checked and rechecked the numbers) refinancing can be a good idea.

Pro: Say you have a balloon interest rate on your mortgage. It is locked in for only a few years at a low rate, but after that, it will start rising (hence the name balloon). If you know that you are going to be in the home for a long length of time (at least over the next few years) you should do everything you can to get into a fixed interest rate mortgage, even if it costs a little on the front end. Balloon interest rates are merciless to the long-term home or property owner.

Pro: You have lived in your home for at least a few years and find out that you and/or a spouse are going to lose the major source of income. As long as you KNOW (to the best of your knowledge) that you will still be able to make your mortgage payment (if lowered by refinancing), AND the necessary payments needed to stay alive and functioning will still be covered, AND you don’t want to sell, then I recommend trying to keep your home.

Refinancing while you have steady income into a lower payment plan can be smart. Also, taking equity out of your home to pay it’s payments while you look for a new job can also be wise. The trick is, you have to do this before the income stops. The banks need to see steady income to approve a refinance. If you can refinance quickly into a 30 or even 40 year loan and cash out some of your equity to make sure you can pay your payments until you get another job, then refinancing may have just saved your house.

If you just wait until the income stops you may be forced to foreclose (losing all the built up equity) if you can’t sell your home in time. If you can refinance and use the equity to pay your home loan, you buy yourself precious time to get another source of income secured before defaulting.

Pro: You got a divorce and one of the two of you ended up with the house. In most divorce stipulations you have to refinance within a certain period of time. Mine was a six month period. I have a few more months of that left but since February I’ve been watching the market. This morning I was able to lock in the lowest rate I’ve seen: 2.625% interest on a 10 year fixed down from the 3.25% that I’m at right now. And because I’m not pulling any equity out, I will not be starting my amortization schedule over (as discussed below). In fact, I will actually be saving $2,000 after calculating in the closing costs and appraisal fees. My payment will be slightly less than it is right now but I plan to pay a little extra monthly to make the length of the loan even shorter.

Something that I was unaware of is that since I do have quite a bit of equity in the home (over 60%), I do not have to do home updates (granite, new paint, landscaping, etc.) to raise its value like I thought I would. I have done the landscaping already (which was fairly inexpensive, just labor intensive). I did buy a lot of paint but it was inexpensive as I buy mis-tinted gallons. I’m not bummed about the money spent because many rooms in my house really do need to be repainted. But thankfully I didn’t buy the granite yet. Despite looking around at multiple places, I couldn’t find a slab I liked. So throughout this process, I learned something new: If you have a lot of equity and you aren’t ‘cashing out’ in your refinance, you really don’t need to spend money, work, and time to get your home to appraise for more. Ask a trusted real estate agent about this.

Something else I learned in this process is that if you don’t qualify for a home refinance as a single person, you may be able to ask the courts to strike the requirement to refinance from your divorce decree. I talked with a woman whose lawyer helped her understand this. She couldn’t qualify by herself on a refinance and was very stressed as her deadline to refi got closer and closer. Her lawyer said the courts will NOT take your home IF you cannot qualify to refinance.

Another thing you may be able to do to avoid having to refi is to talk to your ex-spouse. He/she may be happy to continue benefitting from the increase in their credit history and score (assuming you pay your mortgage on time) by allowing you to keep their name on the home loan. If they need to buy a house later or need to run credit all that is needed (per a lawyer’s advice) is proof that you are the owner and not them (your quit claim deed) and that you have been making the payments (your bank statements). With this information, their loan officer will not use the mortgage loan against them on their credit/loan application. I talked with my ex and he didn’t want to go this route.

Pro: This is only for those who know exactly what I am talking about. If you have investment opportunities where the principal is almost 100% secure a pro to refinancing is using your equity to grow wealth. If you can get a much higher interest rate investing in secure investments than you are paying on your home it may be a good move. I personally love security too much to do this, but I know millionaires who utilize their equity in their homes and invest that money. They can earn three times the interest (sometimes more) on the same dollars.

I really discourage anyone from doing this who isn’t investment savvy AND who isn’t sure that their principal is secured. Warren Buffet said the number one rule to investing is to NEVER LOSE YOUR PRINCIPAL. The number two rule is to NEVER FORGET RULE #1. If in doubt don’t invest the money that provides a roof over your head…. And NO MATTER what, stay far away from the stock market when it comes to your security/home funds. I know too many people who have lost everything if not almost everything. I invested in the market for five years in very “wise” investments and I came out five years later much poorer (even though I sold when the market was up again). Once the market goes down it takes two times as long or longer to make a profit because you have to make up for what you have lost before you can gain again. Market, in most cases, equals loss.

So if you are one of very few who have great investment opportunities that are SAFE, then using some equity to grow your money isn’t always a bad idea. I highly discourage it though.

Pro: (This is more an emotional/will power reason). Say you have enough income to pay more to your mortgage but you won’t if you don’t HAVE to, in this case, refinancing may be the best way to make it happen. If you are in that scenerio (and setting up an automatic payment plan through your mortgage lender/bank still doesn’t work), perhaps refinancing will force you to make these larger payments and sacrifice some spending elsewhere. In this case, refinancing from a 30 to a 15 year loan (as long as you truly can afford it and you just choose not to) can be a pro.

Cons

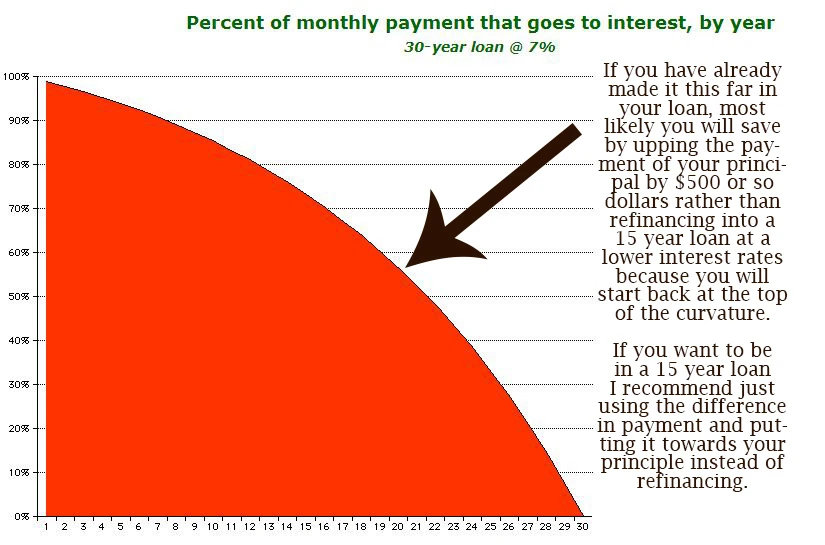

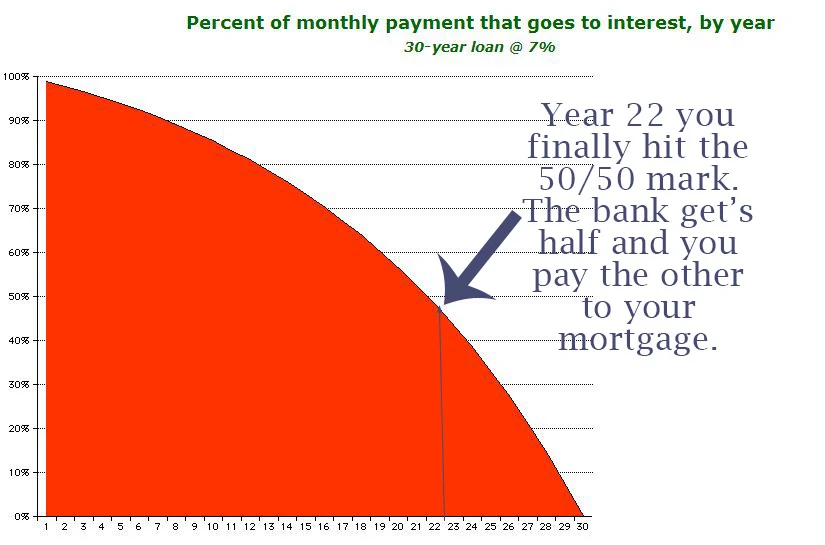

When you refinance your amortization schedule starts over. If you pull money/equity out you start paying a higher amount of interest (like most do). When you buy a mortgage, the first 22 years on a 30 year loan with a 7% interest rate costs more in interest than you are paying off towards the principal. You could be paying a thousand dollars a month ($12,000 a year) and at the end of the first year have only paid off $840.00 on your principal. The next year you may have paid off a total of $2,000 over those two years. If you go refinance in the first few years, you could end up paying much more in fees than you have even paid towards your principal. Finally, in year 22, you will pay $6,000 in principal that year and the bank gets the other $6000 in interest.

Con: You empower banks. I don’t care what your political stance or even if you work at a bank. It’s common knowledge that banks want to make a profit.

As I wrote in this article, banks entice American’s to refinance or sell. The average American does this every 8 years. Therefore, the banks keep earning 97-82% interest on all of the 30 year mortgages out there. Granted, oftentimes when you refinance you most likely won’t be starting your loan at the same place (dollar amount) as you started it years earlier, but if refi at a higher amount you will start paying a higher percentage of interest. Crunch the numbers again and again and be very careful. Consider whether you will be staying in this home for a lifetime or just a few years. More than likely, by refinancing you are handing the bank over even MORE money than you would have if you had just increased the amount you put towards principal monthly and pay your loan off faster.

Con: The refinancing fees. Refinancing is not free. In fact, when I was talking to multiple different brokers the LOWEST rate I could find to refinance is $2,500!!+ more FEES!! It was going to cost us at least $4,000 to refinance after all was said and done. We would have lowered our interest rate .25%. But after crunching the numbers what seem like a hundred times we lost every time. Beware of the massive amount of money the refinancing fee is. If you are on a 30 year loan you might have only paid off $4,000 toward your principal the first 4 years of paying off your loan. Depending on the new terms of the loan and how long you plan to stay in the house, you will probably save much much more by applying that $4,000 to the principal of the loan instead of paying it towards fees to refinance.

Con: Time, paperwork, and inconvenience. When we were closing on our home I was busy (as well as my wonderful, trustworthy real estate agent Susy Foster and our awesome mortgage loan officer) almost everyday for 45 days, gathering paperwork, faxing documents, confirming tax papers, etc. It took so much time to secure the home loan. I had to take a total of a full day off of work and spent hours on closing. Refinancing is also going to take time and hassle. If you can avoid it I highly recommend it.

Con: Your credit score has to be pulled when you refinance. If you decide to shop around to try to secure the best broker (which I recommend if you are set on refinancing) for the lowest cost, each one will ask you if they can pull your credit before they quote you. After your credit is pulled multiple times it starts to affect the score. I ALWAYS said no to them pulling my credit score and eventually after they realized how resolute I was on getting a quote without them messing with my credit, they would tell me the flat refinancing fee or the percentage they charge – EVERY single time. Don’t allow them to tell you they can’t help you until they pull your credit. Just tell them you will move on. Stick to your guns and you will get answers.

Con: Having to have a home appraisal done. I prepped for weeks before our appraiser came (the first time we had an appraiser was after four months of a whole-home-renovation). It cost me a lot of money to clean up the house and yard, get new mulch, buy new outside lighting, take a day off work (because he could only come during the day), etc. When we were thinking about refinancing I cringed thinking that I’d have to prepare and clean every nook and cranny like that again. Oh, and usually you have to pay for this appraisal which runs anywhere from $400-$1,000 depending on location—and make sure to have the bank order it that you will refinance through so you know they accept it. If you do have a lot of equity (usually over 40-50%) and you aren’t wanting to pull money out in your refinance, you really don’t need to spend money, work, and time to get your home to appraise for more by doing additional updates to qualify for the refinance. Ask a trusted real estate agent about this.

So there you have it. My pros and cons to refinancing.

If you are in a life changing situation as mentioned above perhaps refinancing is the wisest thing to do.

But I found that in most cases you could pay your mortgage off faster by applying what you were going to spend on the refinancing fees to the principal and/or by setting up a higher payment plan. If your main goal is to pay your house off sooner then crunch the numbers to make sure you know what you are doing before.

Make sure to account for the fact that if you do refinance at a higher loan amount, you will start at the top of the curvature/amortization schedule on that amount of loan which equals more interest paid all over again plus have thousands to pay towards fees! My guess is that the majority reading this will save by NOT refinancing and just upping the principal payments… but there are odd situations (like my recent one) where this is not the case.

Do you have a pro or con to add if so please let me know?

For other ‘rich living’ and financial tips, please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.

Cons loan refinancing Midhurst auto pros - Badcreditcardealerships

Wednesday 2nd of October 2019

[…] The Pros and Cons of Refinancing – Live Like You Are Rich – My pros and cons to refinancing. If you are in a life changing situation as mentioned above perhaps refinancing is the wisest thing to do. But I found that in most cases you could pay your mortgage off faster by applying what you were going to spend on the refinancing fees to the principal and/or by setting up a higher payment plan. […]

Pros refinancing loan cons Roslin auto - Anycreditcarloans

Tuesday 1st of October 2019

[…] The Pros and Cons of Refinancing – Live Like You Are Rich – My pros and cons to refinancing. If you are in a life changing situation as mentioned above perhaps refinancing is the wisest thing to do. But I found that in most cases you could pay your mortgage off faster by applying what you were going to spend on the refinancing fees to the principal and/or by setting up a higher payment plan. […]

Refinancing Pros and Cons: Study Up Before Making Decisions - Shakadoo

Friday 24th of June 2016

[…] many great things about refinancing- but there are also some horrible pitfalls. Read this post by Anita at Live Like You Are Rich before making any big […]

GG

Wednesday 3rd of February 2016

Thanks for a great article! Cheers :-)

Anita Fowler

Wednesday 3rd of February 2016

Thank you so much and for your kind tip. I got that taken care of.

7 Ways to Get Rid of Private Mortgage Insurance

Thursday 19th of November 2015

[…] Sixth, If you will end up being able to put down 20% on your new loan, you could try refinancing. Refinancing can be a costly decision. Before you refinance read my Pros and Cons of refinancing here. […]