Most Americans are in quite a bit of consumer debt. Consumer debt (also known as bad debt) is accrued by purchasing items that you don’t have the money to pay for. Living a rich life (materially and non-materially) requires that you have financial peace of mind.

Financial peace of mind cannot come when you don’t have enough to pay the bills and are consistently racking up debt. It comes through discipline. spending less than you make, getting out of debt, and setting excess money aside for security purposes.

How to Get Out of Debt

1. Avoid adding to the debt (see post here on step by step directions). Just as the first step in stopping a sinking boat is to plug the hole where the water is leaking in, the first way to get out of debt is to avoid adding more to it. So, if you haven’t read it yet, please hop over and read this post on How to Avoid Debt and then come back.

2. Itemize your debts from lowest to highest amounts (first by the amount of the debt owed, and then by the interest rate).

The reason for this is that the smallest loan(s) can usually be paid off quickly. If you can get rid of a few of the debts that are smaller (even if they have low interest rates) quickly it will boost your confidence and help keep you going.

Often people pay the highest interest rate off first. But if you have a furniture loan of $700.00 with a 7% loan and a credit card of $10,000 at a 14% loan even though the credit card has the higher interest rate, it is best psychologically to pay the furniture loan off first and have one less debt to worry about. Then move onto the credit card.

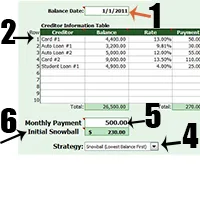

The exception to this is if the loans are very close in the amount owed and the interest rate is very different. Take for example the same credit card of $10,000 with a 14% interest rate and a car loan of $9,000 with a 4% interest rate. You will want to pay off the credit card before the car loan to save money in interest. The way to stack and pay off the debts is of course up to you. Click this link for a free excel file that will help you to learn how to calculate your real debt and determine the quickest least-expensive way to pay it off. The most important part is having an order in which you will pay them off and a solid plan.

Example: Jack and Jill’s Debt Payoff Plan:

Debt 1: Furniture $700 Interest rate 7% Min. Payment $100.00/mon.

Debt 2: Credit Card $10,000 Interest Rate 14% Min. Payment $75.00/mon.

Debt 3: Car $9,000 Interest Rate 4% Min. Payment $350.00/mon.

Debt 4: Mortgage $150,000 Interest Rate 4.5% Min. Payment $1,000.00/mon.

3. Now once one debt is paid off you take the payment you were making monthly to that debt and apply it to the next debt on the list.

So if the furniture payment was $100/ month then you would take the $100.00 a month and apply it to the credit card (or the next debt in line to be paid off). If the credit card payment was $75.00 a month you are now paying $175.00 a month towards the balance.

Once the credit card is paid off you will move that $175.00 to the next debt on the list, the $9,000 car loan. The car loan was $350/month and you’ve added the $175.00 to it, so now you are now paying $525.00/month towards the car. Once the car is paid off you would apply the $525 to the next debt. Say it is the home mortgage of $150,000. with a monthly payment of $1,000.00 and an interest rate of 4.5%. You will now be paying $1,525.00/month to your home and will save considerably in interest!

After you are finished paying off your debts in this manner you will realize that you have paid them much faster than the minimum payments were designed for. Therefore, not only did you save in interest but if you reinvest the $1,525.00 payment you’ve been making monthly into something like a real estate fix and flip property, or a business venture, you will have made additional money in the same time you would have originally been in debt!

IMPORTANT: Whenever you apply any additional funds to a loan in most cases you must SPECIFY to the bank or to the loan company that the additional funds you are paying MUST be applied to the principle and not to the interest. If you do not specify this the bank will typically act as if you are paying for the payment one month early and will force you to pay interest with those additional funds.

4. How to get out of debt even faster?

If you can free up funds by learning how to save money (here is a post on couponing and a post on saving with a smart phone here), or if you can make additional money (check out this post on how to make money), and cut expenses (I talk about this in the how-to avoid debt post) you will get out of debt much faster!

5. Go over your plan and recommit yourself (and spouse/family) at least once a month. I found that the more I looked at my plan when we were getting out of debt the more resolved I was to not overspend or get off track. Consistency is probably the most important step.

Important Life Changing Bonus Tip: Once you have paid off your debt, take the payment you were making each month to the last debt on the list and reinvest it. Here are some good/wise investment principles and investments. A wise man once said, “There are two types of people in this world, those who pay interest and those who earn it”. When you are out of debt you can start earning interest. Albert Einstein said that compound interest is the most powerful force in the universe (more on why here). So take that same money you were paying on your debt and save and grow it in a wise investment. Not convinced? Head on over to this post to see how doing this tip will earn me over 1/2 million dollars in the same time frame that we may have been in debt!

The quicker you can get out of debt the more money you will save because it costs money in interest to owe money. Take these 5 steps, stay consistent and you will get out of debt sooner than you ever thought possible!

I have detailed yet easy-to-read graphs and charts that show this 5 Step process of getting out of debt as a step-by-step process in my book. These charts also show how much money is saved by stacking and paying off debt in this manner. Further, the graphs have figures showing how much money can be made if a debt is paid off like this and reinvested for the same time frame as the original loan schedule. They are found in my new book I co-authored: Living a Rich Life as a Stay-at-Home Mom: How to Build a Secure Financial Foundation for You and Your Children

Need help getting and staying out of debt yet want more interactive help take my FREE 31 Day Financial Fitness Boot Camp Course (by clicking here).

Other articles that may be of interest to you:

How to calculate your real debt and determine the quickest least-expensive way to pay it off

The difference between good and bad debt

For other ‘rich living tips’ and financial tips, please subscribe, like me on Facebook, and follow me on Pinterest and Instagram.

SUBSCRIBE FOR OUR EMAILS

linda

Thursday 7th of July 2022

I must say this was very helpful and easy to understand.

Diane taber

Monday 3rd of February 2020

Hi we really want to be debt free and then and only then start to build wealth for our future.

Diane taber

Friday 31st of January 2020

Hi we really want to get out of debt and build wealth

How To Tackle ‘Debt Stress’: 5 Top Tips | Live Like You Are Rich

Tuesday 1st of November 2016

[…] thinking about a general ‘big’ unwieldy debt you may have. It also empowers you to create a get out of debt action […]

Live Get Out Of Debt | submit - debt collectorsn usa

Tuesday 3rd of November 2015

[…] How to Get Out of Debt | Live Like You Are Rich – 6 Responses to How to Get Out of Debt. Marisela says: … © 2015 Live Like You Are Rich. Thanks for sharing… Buffer; Diggit; Email; More; Facebook; Flattr; Google+ … […]